Singapore Records Promising Growth in Business Formations

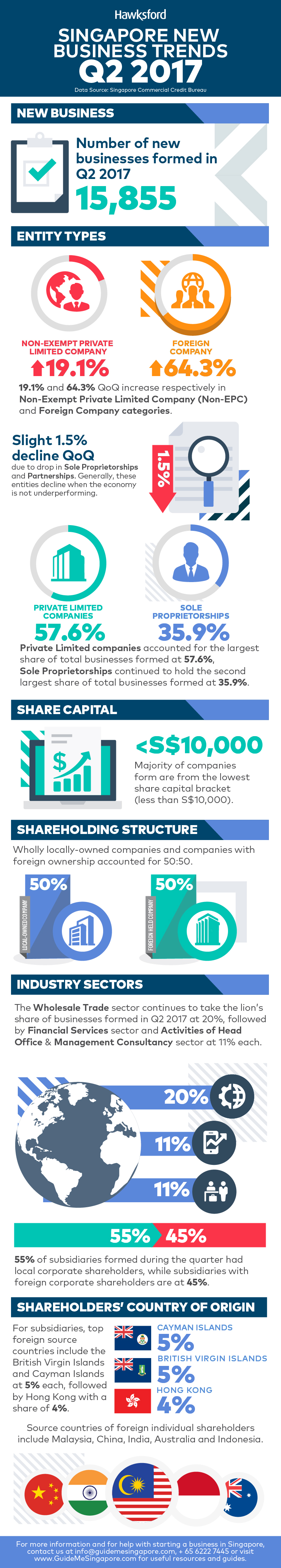

The number of new businesses formed in Singapore totaled 15,855 in Q2 2017, signaling an upswing in business sentiments in spite of a slight 1.5% decline quarter-on-quarter (QoQ), according to Hawksford's Singapore New Business Trends Report Q2 2017.

This positive outlook arose as the 10.1% decline in business formation year-on-year (YoY) was largely attributed to a fall in the formation of Sole Proprietorships and Partnerships. These categories typically hike in an under-performing economy.

While Singapore continued to attract individual investors and entrepreneurs from Malaysia, India, Australia and Indonesia during the quarter, the British Virgin Islands, Cayman Islands and Hong Kong were among the top foreign source countries of subsidiaries formed during the quarter.

(I) Business Formation by Entity Type

Backed by a global economic rebound, the number of business formations in the Non-Exempt Private Limited Company (Non-EPC) and Foreign Company categories registered a 19.1% and 64.3% increase QoQ in Q2 2017 respectively. Despite these categories accounting for 9.8% and 0.3% of total businesses registered in the quarter, this is reflective of an uptick in business optimism as Non-EPCs are typically larger companies. In addition, the rise in the number of Foreign Companies formed underpins Singapore’s reputation as the preferred launch pad for regional business operations.

While Private Limited companies accounted for the largest share of total businesses formed during the quarter at 57.6%, Sole Proprietorships continued to hold the second largest share of total businesses formed at 35.9%.

(II) Business Formation by Share Capital

The share of businesses formed in each of the 4 capital tiers remained largely unchanged in Q2 2017, with the majority of companies formed being in the lowest share capital bracket (of less than S$10,000). Consistently ranked as one of the easiest places to do business in the world, Singapore is widely-recognised for its pro-enterprise, business-friendly environment that enables quick and easy set-up. Companies, for instance, are allowed to be incorporated with a nominal share capital of just one Singapore Dollar.(III) Business Formation by Shareholding Structure

In Q2 2017, wholly locally-owned companies and companies with foreign ownership accounted for half of company formations each.

Within the share of companies with foreign ownership, the share of wholly-foreign held companies increased by 1% QoQ to 38%, while the share of companies with mixed shareholding dropped marginally to 12% against 13% in the preceding quarter.

The figures, which remain largely stable QoQ, hint at global recovery and a revival of regional business prospects influenced by accommodative monetary policies and increased government spending in Asia.

(IV) Business Formation by Industry

The Wholesale Trade sector, which continues to take the lion’s share of businesses formed in Q2 2017 at 20%, increased by 1% QoQ, reflecting a surge in global trade. The marginal drop in the Financial Services sector from 12% to 11%, however, is seen as transitory and is expected to reverse if regional recovery continues to strengthen in the second half of 2017.

The 11% share held in Q2 by the Activities of Head Office & Management Consultancy sector recorded an increase of 1 percentage point over the preceding quarter. The rise in company formations in this sector reflects Singapore’s efforts in keeping its business environment ideal for the setting up of head offices and treasury activities. This includes the provision of world-class infrastructure, an English-speaking workforce, as well as a robust judicial regime.

(V) Business Formation by Shareholders’ Country

While 55% of subsidiaries formed during the quarter had local corporate shareholders, the top foreign source countries for subsidiaries formed include the British Virgin Islands and Cayman Islands at 5% each, followed by Hong Kong with a share of 4%.

On an individual level, Singapore continued to attract investors and entrepreneurs from Malaysia, China, India, Australia and Indonesia in Q2 2017. The share of these source countries remains largely unchanged against the preceding quarter.

“Singapore clearly outranks as the choice investment destination with a dynamic and open business landscape that continues to attract investors and entrepreneurs from all over the world. Given the upswing in a global economy that is fast gathering momentum, we expect business formation in Singapore to register a spike in the second half of the year,” said Ms Jacqueline Low, COO, Hawksford Singapore.

Download the full report